How to Lower Property Taxes in Texas? (2026 Update)

Learn how to lower property taxes in Texas, and how to leverage exemptions for max savings.

As a Texas homeowner, property taxes can be a significant expense, especially as we make our way towards the 2026 tax season.

With property values rising rapidly due to a huge influx of migration to the state, many Texans are facing higher property tax bills each year.

However, there are ways to potentially reduce your tax burden and seek Texas property tax relief. Read further to learn how to lower property taxes in Texas.

Understanding Property Tax Assessments

In Texas, property taxes are determined by local County Appraisal Districts (CADs), which assess the market value of your property annually as of January 1, 2026.

This assessed value is used to calculate your property taxes, a bill you pay annually that is one of the highest variable costs of homeownership. Understanding this process is the first step to identifying potential Texas property tax relief.

How Do Property Tax Assessments Work?

Market Value Assessment: First, CADs determine your property's market value based on comparable sales, construction costs, and other relevant data. Using comparables is a big part of what determines your bill.

Appraised Value: The appraised value is the dollar amount assigned to your property after considering any exemptions you may qualify for. You can type you appraised value into the calculator here to see what it might be for 2026.

Taxable Value: This is the value on which your taxes are calculated, derived from the appraised value minus exemptions.

So, How Can I Lower My Property Taxes in Texas?

The age-old question. Let's dive in.

1. Review Your Property Tax Notice

Each year, you'll receive a Notice of Appraised Value from your local CAD.

Carefully review this notice for any errors or discrepancies, such as incorrect property details or overvaluation compared to similar homes in your area.

Who is in charge of sending you the Notice of Appraised Value?

Here are the most popular local County Appraisal District (CAD) websites in Texas, which provide resources and tools for homeowners to manage their property taxes:

- Harris County Appraisal District (HCAD): Covers Houston and surrounding areas, providing property search, exemptions, and protest filing services.

- Dallas Central Appraisal District (DCAD): Offers resources for property valuations, exemptions, and appeals for Dallas County.

- Bexar Appraisal District (BCAD): Serves San Antonio and Bexar County with property searches, exemption applications, and protest information.

- Travis Central Appraisal District (TCAD): Provides property information, exemption details, and protest procedures for Travis County, including Austin.

- Williamson Central Appraisal District (WCAD): Serves Williamson County with property information, exemption details, and protest procedures.

2. Gather Evidence for an Appeal

If you believe your property is overvalued, gather evidence to support your claim:

- Comparable Sales: Find recent sales data of similar properties in your area.

- Property Condition: Document any damages or issues that could reduce your property's value.

- Independent Appraisal: Consider getting an independent appraisal to provide an objective valuation.

3. File a Property Tax Protest

If your assessment seems too high, you have the right to protest:

- File a Notice of Protest: Submit this to your local CAD, usually by May 15 or 30 days after you receive your notice.

- Prepare Your Case: Use the evidence you've gathered to build a strong case.

- Attend the Hearing: Present your evidence to the Appraisal Review Board (ARB) and make your argument for a reduced assessment.

4. Utilize Property Tax Exemptions

Texas offers several exemptions that can reduce your property's taxable value:

- Homestead Exemption: Available for primary residences, it can reduce your taxable value by $25,000 or more.

- Over 65 or Disabled Person Exemption: Provides additional reductions for senior citizens or disabled homeowners.

- Veteran Exemptions: Available for disabled veterans or their surviving spouses.

More Strategies for Reducing Texas Property Taxes in 2026

1. Appeal Every Year

Even if you succeed in lowering your assessment one year, continue to appeal annually. Property values and market conditions change, and your assessment could increase again. This can provide ongoing Texas property tax relief.

2. Hire a Property Tax Consultant

For complex cases or significant potential savings, consider hiring a professional property tax consultant. They have the expertise and resources to handle appeals effectively and can often secure greater reductions, ensuring you receive maximum Texas property tax relief.

3. Monitor Changes in Tax Rates and Laws

Stay informed about changes in local tax rates and legislation that could affect your property taxes. New laws or rate adjustments can impact your tax bill and provide additional savings opportunities for Texas property tax relief.

Leveraging Technology to Track and Manage Your Property Taxes

1. Use Online Tools

Several online tools and platforms can help you track your property's assessed value, compare it with similar properties, and manage your tax protests.

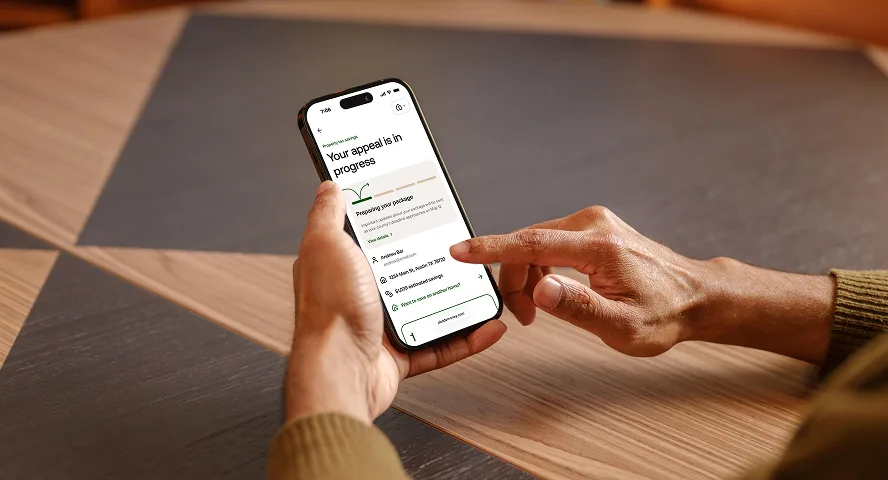

2. Abode Money's Property Tax Appeal Service

Abode Money offers comprehensive property tax services to help you review, appeal, and manage your property tax assessments. Our platform provides detailed insights, evidence collection, and expert guidance to maximize your savings.

If you want to check your specific county's property tax rates and information, check out our Texas property tax insights.

You can learn more how Abode Money compares to other property tax appeal services from a review here.

Conclusion

Property taxes can be a significant financial burden, but you can save thousands of dollars each year with the right strategies.

By understanding your assessment, utilizing exemptions, and leveraging professional help, you can lower your property taxes in Texas this year!

FAQs

Q: How often can I appeal my property tax assessment in Texas?

A: You can appeal your assessment annually.

Q: What is the deadline to file a property tax protest in Texas?

A: The deadline is typically May 15 or 30 days after you receive your notice of appraised value, whichever is later.

Q: Can my property taxes increase if I file an appeal?

A: While rare, it's possible if the ARB finds that your property was initially undervalued.

Q: What are the benefits of hiring a property tax consultant?

A: Consultants have specialized knowledge and resources that can improve your chances of a successful appeal and greater savings.

Q: How to lower my property taxes in Texas?

A: Learn more about your county's process and sign up with Abode Money to get started.

Q: Are there any risks to appealing my property tax assessment?

A: The primary risk is the time and effort involved if your appeal is unsuccessful. However, the potential savings often outweigh the risks.

Q: Did Texas pass property tax relief?

A: Yes, Texas has passed significant property tax relief. In 2023, the Texas Legislature approved an $18 billion property tax relief package. This package includes several measures aimed at reducing property taxes for homeowners and small businesses.