Changes to the SALT Deduction Could Affect Property Taxes Nationwide

SALT deduction is a significant opportunity for homeowners to deduct property taxes

Why staying on top of SALT rules matters for your home and your wallet

The State and Local Tax (SALT) deduction has been a cornerstone for homeowners in high-tax states for decades. It allows taxpayers to deduct certain state and local taxes, including property taxes, from their federal taxable income.

However, recent changes to SALT limits have created both opportunities and risks that homeowners need to understand.

What’s changed with SALT

The 2017 Tax Cuts and Jobs Act capped the SALT deduction at $10,000.

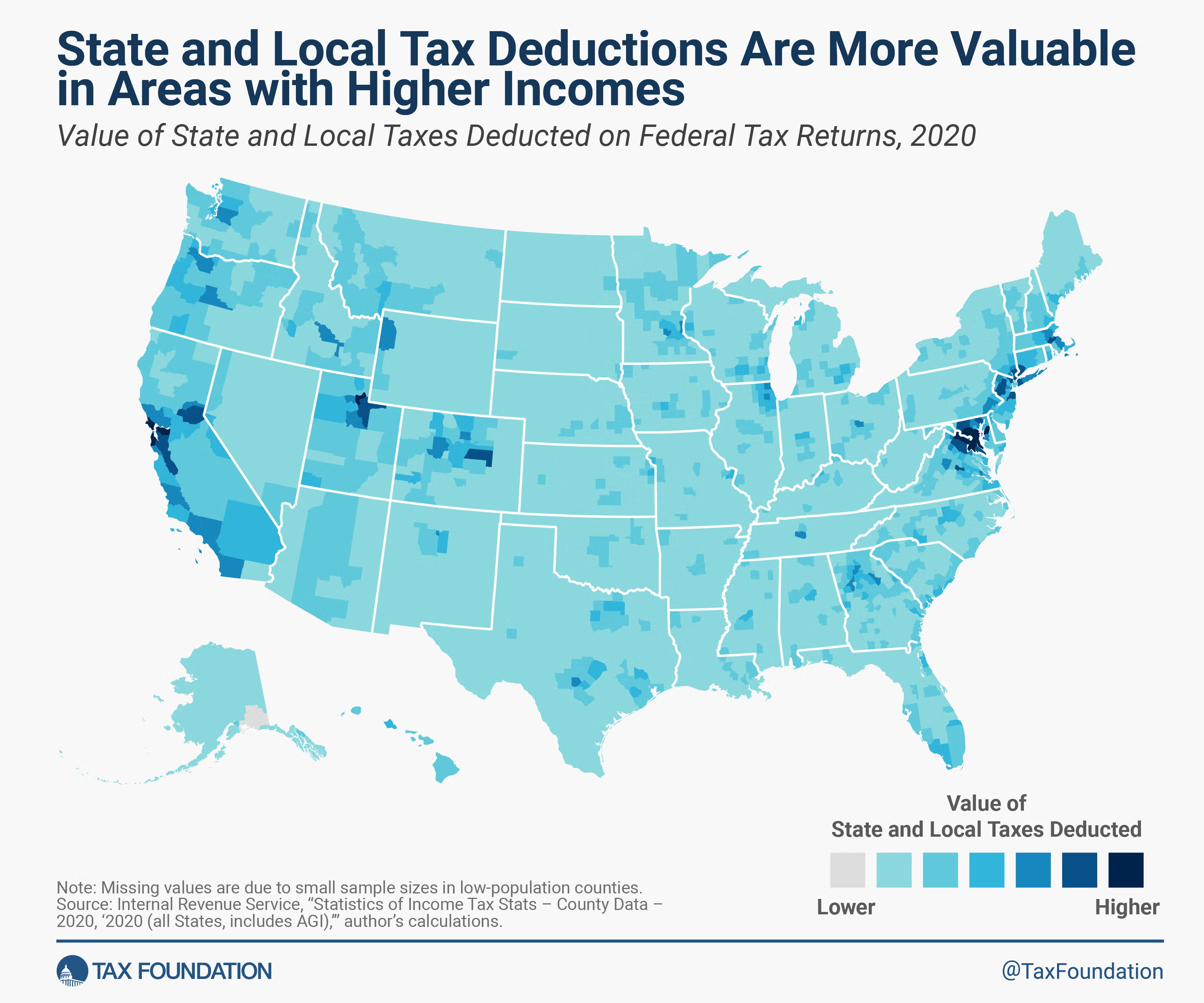

This meant that homeowners in states with high property taxes, like New York, New Jersey, and California, could only deduct a portion of what they actually paid.

In 2025, Congress passed legislation raising the cap to $40,000 for tax years 2025–2029, with a phase-out for individuals earning over $500,000.

For homeowners, this is a big deal: higher SALT deductions reduce federal taxable income, effectively lowering your overall tax burden—but only if your property tax and other eligible state and local taxes are accurately assessed.

Why accurate property assessments matter more than ever

Even with the new SALT cap, your deduction is tied to your assessed property value (the amount of your home’s value that you pay taxes on), not your home’s market value.

Overvalued assessments mean you could be paying more in property taxes than necessary, reducing the benefit of the SALT deduction.

For example:

- If your assessed value is 10% higher than comparable homes in your area, you’re paying extra in property taxes—and the federal deduction you receive is based on that inflated number. Sure, your reduction is bigger because your tax bill was inflated, but you paid more in taxes then you should have, so you’re not getting the full advantage.

- Homeowners in states with high property taxes can see a meaningful difference in federal taxes when assessments are corrected.

How Abode Money can help

Abode Money ensures your property assessment is fair and accurate. We:

- Review your assessment against local comparables and sales data

- Identify overvaluations or errors that may be inflating your taxes

- Guide you through the appeal process so you pay only what you truly owe

By keeping your assessment accurate, you maximize your ability to take advantage of the new SALT deduction and avoid paying extra federal and local taxes unnecessarily.

Conclusion

The expanded SALT deduction is a significant opportunity for homeowners, but only if your property assessment reflects your home’s true value.

With Abode Money’s expert review and property tax appeal support, you can protect your wallet and make the most of these changes. Don’t let an inflated assessment eat into your tax benefits.